nsDAI Strategy

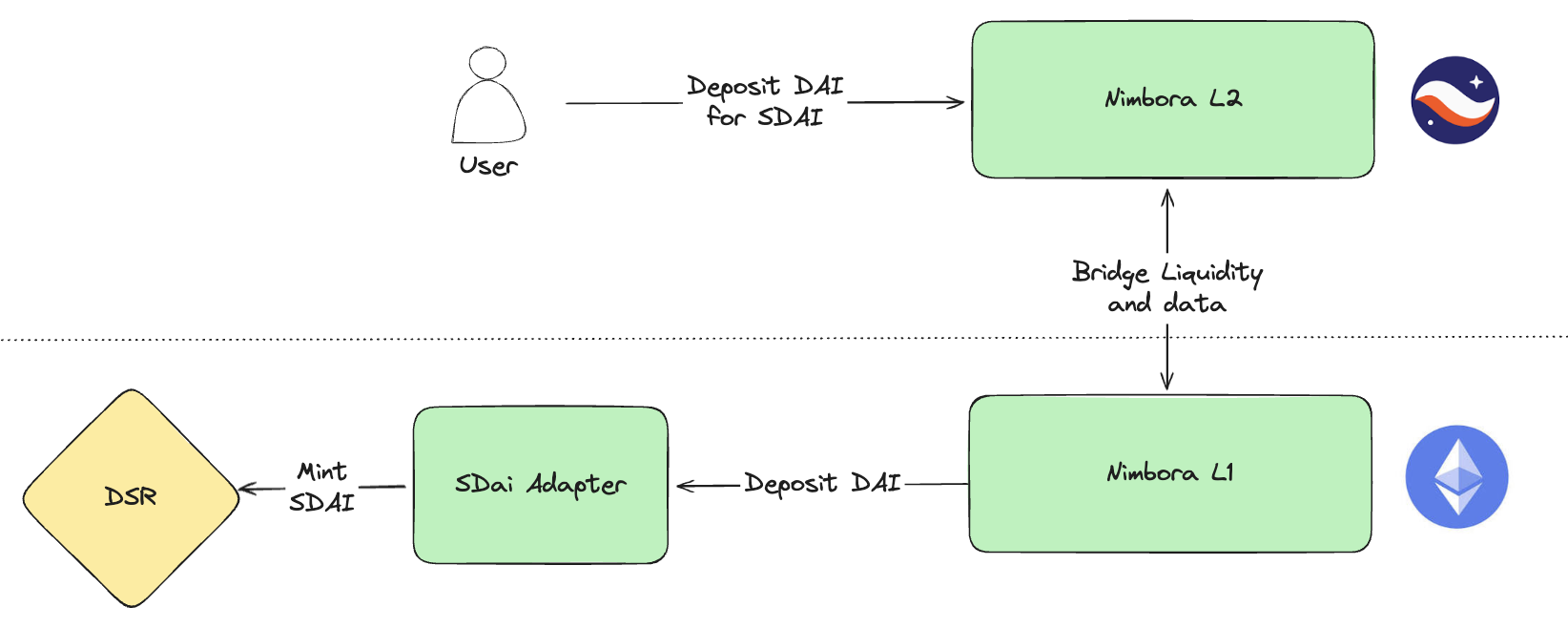

This strategy allows users to leverage their DAI holdings by depositing them into an sDai vault, which is a specialized financial vehicle. This depositing action allows their DAI to be put to work, generating potential profits over time. The approach combines the security of DAI, a stablecoin, with the revenue-generating power of DeFi strategies. This mechanism is designed to provide users with a more effective way to maximize the potential return on their DAI investments.

Source of yields

- Maker Protocol fees coming from DAI borrow and treasury earning.

This strategy is straightforward as the logic is very simple: it consists of depositing tokens into DSR to acquire sDai.

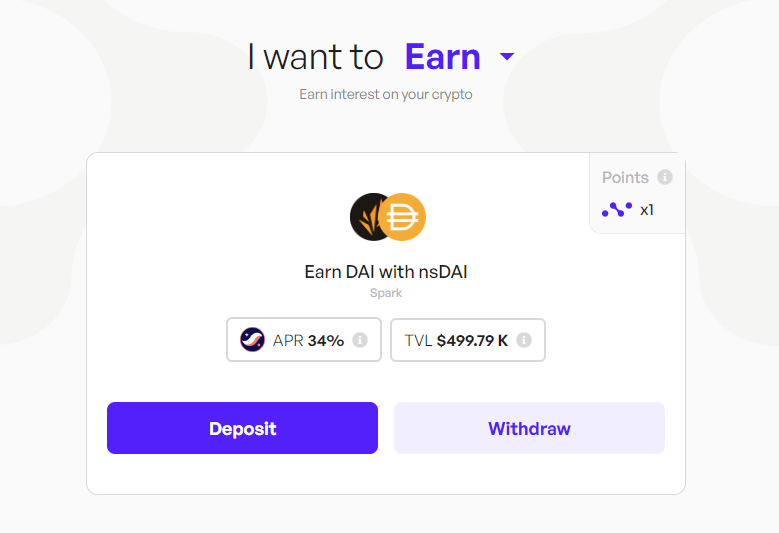

Get Started

Visit Nimbora dApp via invite link and connect your Starknet wallet (Braavos or ArgentX).

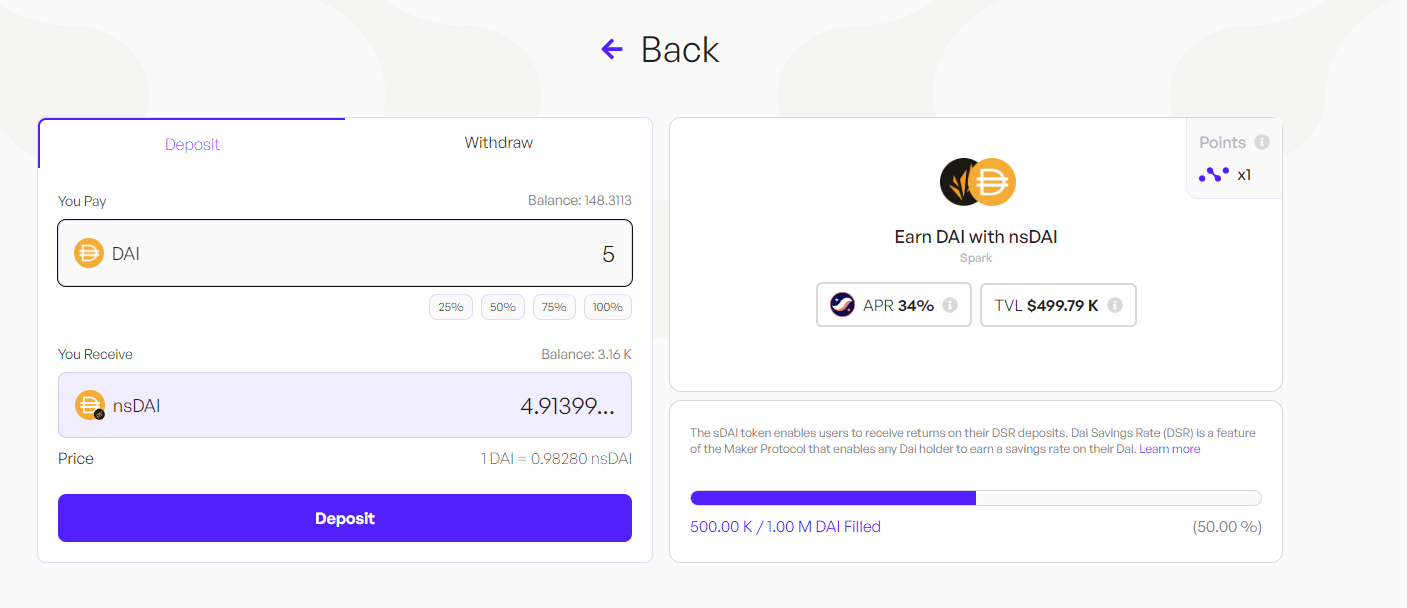

Enter the amount of ETH you want to deposit, or click on the small buttons below the box (25%, 50%, 75%, 100%) to set a desired percentage of the balance you want to deposit.

Enter the amount you want to deposit or click on the buttons to set a desired percentage of your balance you want to deposit.

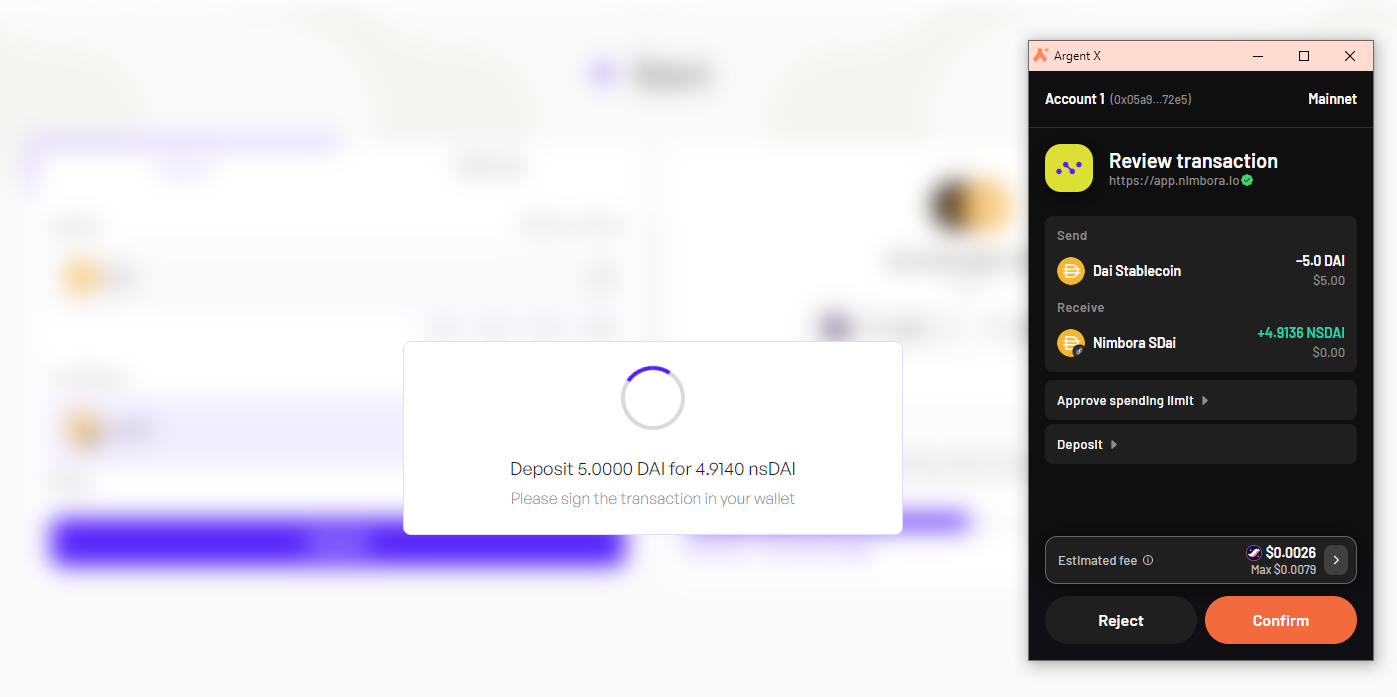

When you've selected the token amount to deposit, click on "deposit" and follow the prompts on your wallet (Braavos or ArgentX) to complete the transaction.

Once the transaction has been accepted on the network, a popup will appear at the bottom right of the screen to let you know.

And that's it, you should be able to see your balance of Nimbora yield token into the portfolio section or directly into your wallet browser.

Your Earning Starts Immediately!

Your yield comes from several sources - nsDAI base yield + $STRK incentives + Nimbora boost.

Here's an APR breakdown of the nsDAI strategy

- Base: Represents default strategy yield that auto-compounds daily. We take a 20% performance fee. The APRs displayed are what you actually receive, as our performance fee has already been accounted for.

- Boost: Represents incentives provided by the Nimbora team using the Starknet Catalyst grant that are claimable every week at the rewards page.

- Incentives: Represents incentives provided by the Starknet Foundation as a part of the DeFi Spring 2.0 that are claimable every week at the rewards page.

- Extra: Ekubo LP Providing Nimbora yield bearing tokens as liquidity on Ekubo is tracked and added to the total claimable STRK amount at the rewards page.

How to request a withdrawal

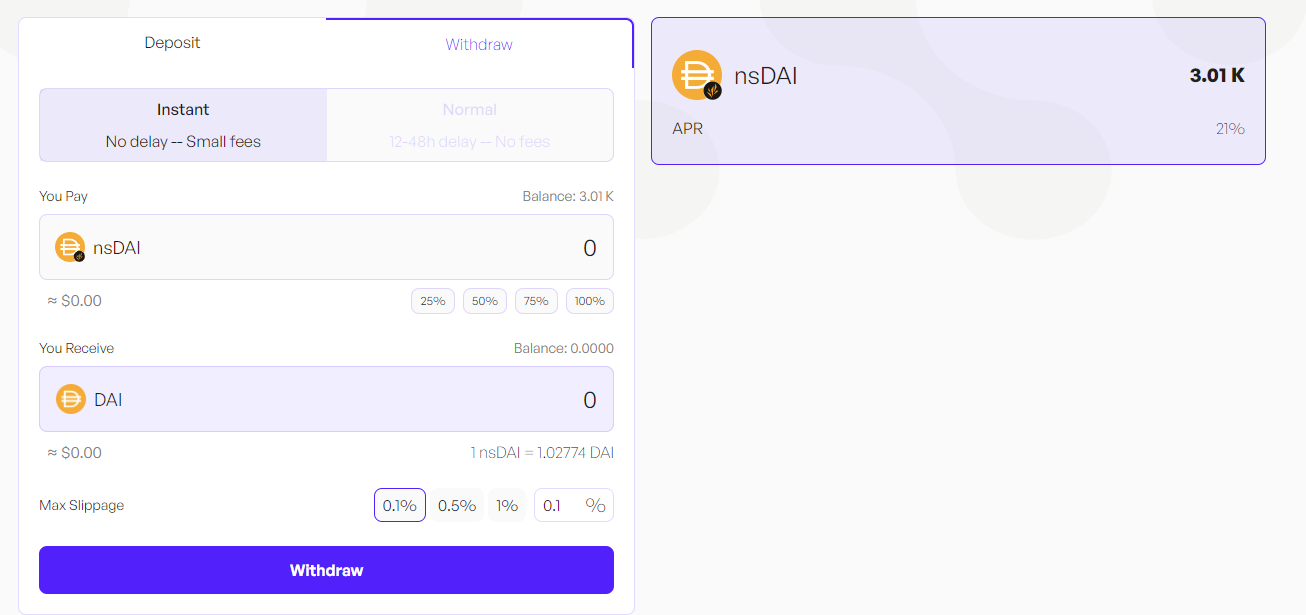

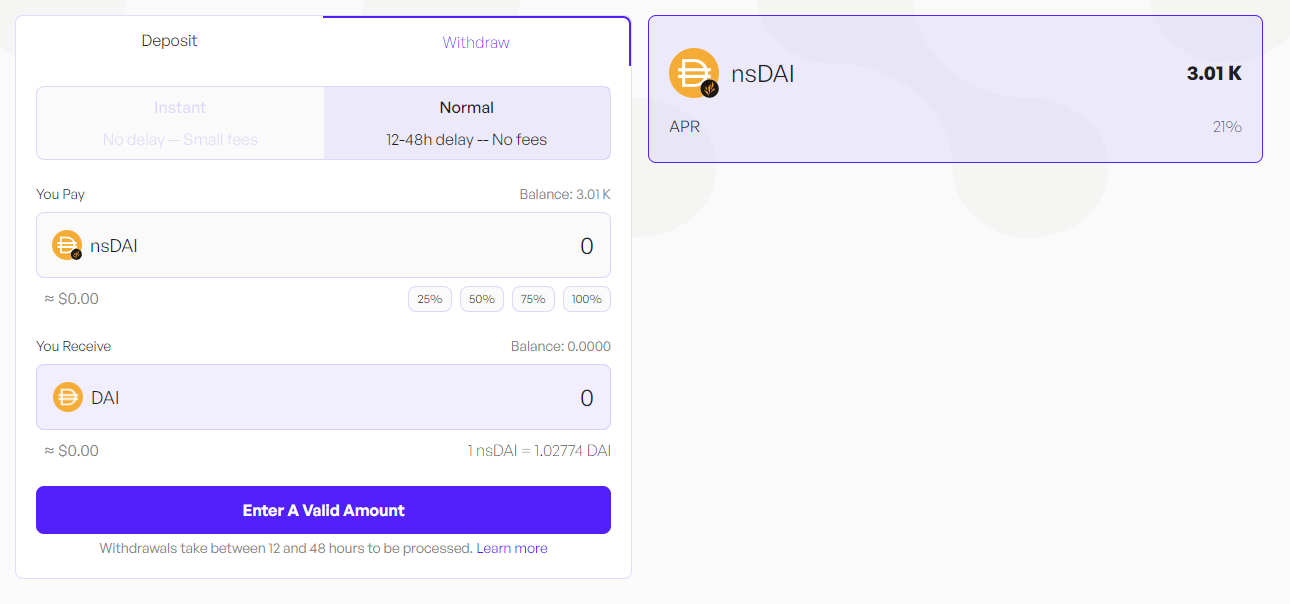

You can choose between two withdrawal options - Instant and Normal.

Instant withdrawals factor in the price impact and set slippage.

Normal withdrawals are not synchronous such as deposits and take between 24 and 72 hours to be processed.

Once you have selected the withdraw tab, you will need to decide on the amount you want to withdraw. This could be all or a portion of your assets.

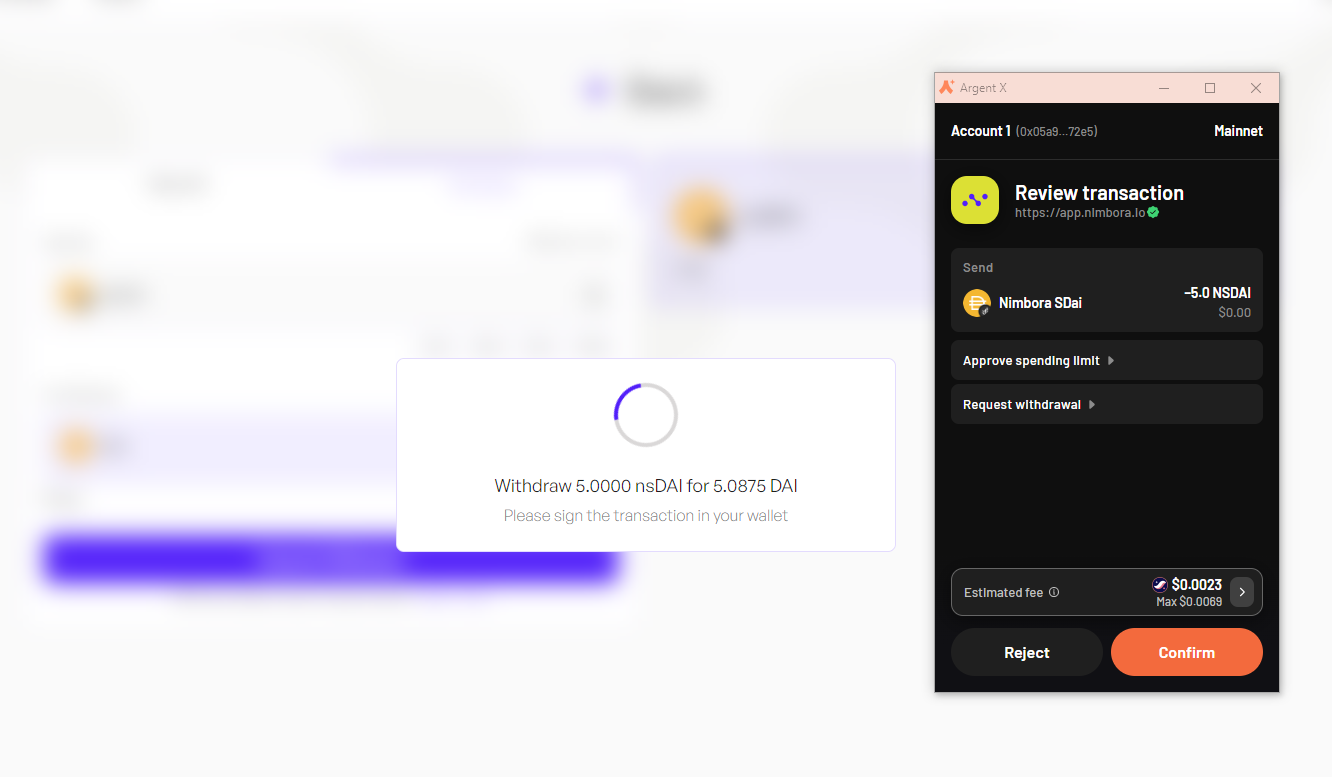

Click on the 'withdraw' button and follow the prompts on your wallet (Braavos or ArgentX) to complete the transaction.

Once the transaction has been accepted on the network, a popup will appear at the bottom right of the screen to let you know.

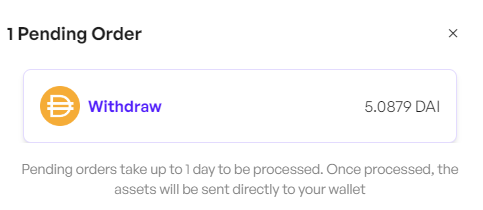

And that's it, you should see your pending request in the navbar.

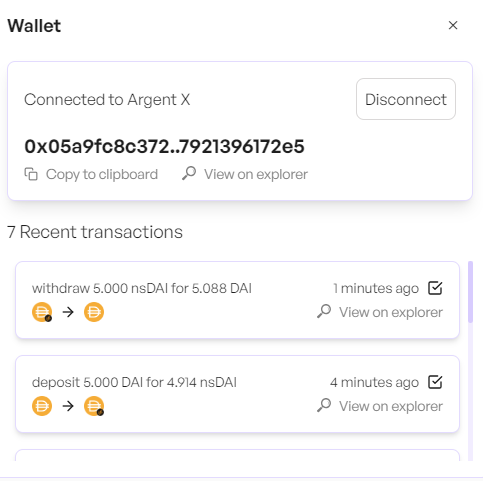

You can consult all of your recent transactions in the wallet section. Your transaction should be here.

Nimbora takes over the task of processing this request. This involves preparing your assets in order to be transferred back to your wallet, a process that is handled entirely behind the scenes to ensure a smooth and efficient operation. Once the request is ready to be claimed, Nimbora relayer will handle it and send it directly into your wallet.

What is sDAI

-

sDAI is a special version of the DAI cryptocurrency that lets you earn extra money (yield) through the Maker protocol, while still being able to use your DAI as usual.

-

You can easily convert your DAI to sDAI and back without needing to use a cryptocurrency exchange, by simply depositing or withdrawing from a specific feature called the Dai Savings Rate (DSR) module.

-

With sDAI, you can do all the things you normally do with DAI, like transferring it to others, staking it to earn rewards, lending it, and more.

-

To use sDAI and take advantage of its benefits, you can go to the SparkLend website and interact with it directly from there.

-

More about sDAI:

What is DSR

-

The Dai Savings Rate (DSR) is a feature within the Maker Protocol that enables Dai holders to earn savings by actively engaging with the DSR contract.

-

To earn savings, users must manually transfer Dai from their wallet to the Maker Protocol, with the assurance that Dai can be instantly redeemed without liquidity constraints, but only back to the original depositing account.

-

Integration of DSR functionality by custodians, decentralized exchanges, wallets, or dapps is advantageous as it allows any user to earn savings on their Dai holdings.

-

More about DSR:

What is Spark

-

Spark aims to enhance the DAI ecosystem as part of the MakerDAO community, positioning itself as a next-generation DeFi infrastructure.

-

It introduces SparkLend, a DAI-focused money market protocol that integrates liquidity from Maker and other top DeFi protocols.

-

sDAI, a yield-bearing stablecoin within Spark, represents DAI in the Dai Savings Rate (DSR) module, funneling revenue from the Maker protocol back to DAI holders.

-

Spark features SparkConduits, enabling direct liquidity transfer from Maker to various protocols. It operates under the governance of SparkDAO, a subDAO of Maker Allocator, scheduled to launch its governance in May 2024.

-

More about Spark:

What is MakerDAO

-

MakerDAO aims to stabilize the crypto economy using a dual-token system: Dai for stability and MKR token for governance, emphasizing the necessity of a decentralized stablecoin for digital financial benefits.

-

It champions decentralized finance (DeFi) accessibility, striving for economic empowerment and equal access to the global financial market for all.

-

The Multi Collateral Dai (MCD) update expands collateral options to include various Ethereum-based assets, contingent on approval by MKR holders.

-

This enhancement introduces new features to the protocol, promoting broader asset acceptance and flexibility.

-

More about Maker:

Understanding Risks Associated with SDAI

-

Smart Contract Risk:

- sDAI, like other DeFi protocols, is susceptible to exploits, including smart contract vulnerabilities and malicious attacks.

-

Regulatory Risks:

- MakerDAO's shift towards RWA-based collateral introduces regulatory uncertainty due to its decentralized nature.

- Increased reliance on RWAs may lead to compliance challenges and potential regulatory gaps.

-

Collateral Risks:

- RWAs' default risks may result in collateral shortfalls, jeopardizing the 1:1 USD peg of sDAI.

- Fluctuations in the DAI Savings Rate (DSR) could strain liquidity buffers if significant amounts of sDAI are minted or burned abruptly.

- RWAs' sensitivity to interest rate fluctuations may lead to losses if redemptions are required before maturity.

-

Collateral Risks:

- MakerDAO's engagement with multiple counterparties exposes it to credit risks such as liquidity, reputation, and settlement challenges.

-

Centralization and Transparency Risks:

- Pursuing additional returns through RWAs may increase centralization within MakerDAO.

- Onboarding RWAs reduces transparency compared to on-chain crypto assets, posing transparency risks.

Stay Tuned for Upgrades

Keep an eye on our updates as we roll out new features and advanced strategies to enhance your earning potential.

Join our Discord for alpha and early notifications 🚀

Stay tuned for updates as we continue to bring more 1-click yield strategies to life. Follow Nimbora on X (Twitter) or Medium.

About Nimbora

Nimbora is a Starknet-based omnichain 1-click yield strategies platform that enables users to engage with Layer 1 protocols at a fraction of the cost. Discover the best of Ethereum protocols and optimize your DeFi strategies with Nimbora.

🐧🌐 Website

🐧👨💻 DApp

🐧👋 Discord

🐧📖 Medium

🐧🗞️ Docs

🐧🛡 LST Audit